Are finance apps rewiring your brain? Discover the psychological impact of fintech on your spending, saving, and financial anxiety in 2026. We explore the behavioral science behind “gamification” and how to use these tools to build real wealth.

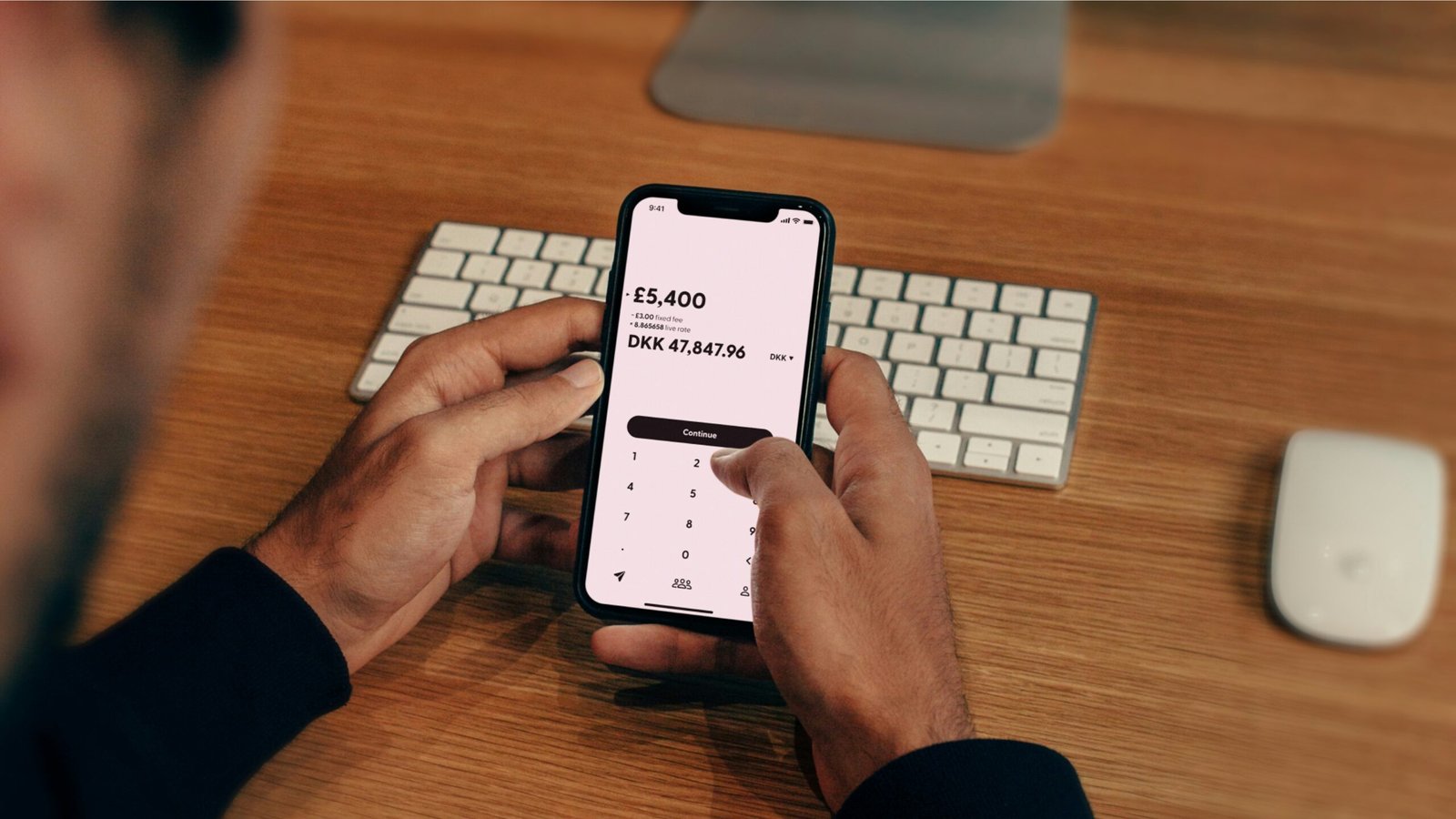

It is 2026. You are standing in line for coffee. You tap your phone, and a satisfying ping notifies you that $5.50 has been deducted from your account. Simultaneously, a different app congratulates you with a burst of confetti for keeping your “Coffee Budget” in the green for the week.

You feel good. You feel in control.

But are you?

The digitization of money has fundamentally shifted our relationship with value. For centuries, spending money involved a physical transaction—counting out bills, handing them over, and watching them disappear. This created what behavioral economists call the “Pain of Paying.” It was a visceral, psychological friction that served as a natural brake on spending.

Today, that friction is gone. In its place, we have a sophisticated ecosystem of personal finance apps, AI-driven nudges, and gamified interfaces designed to modify our behavior.

This isn’t just about convenience; it is about neurology. The apps on your phone are actively rewriting your financial habits, for better and for worse.

In this deep dive, we will explore the unseen psychological impact of personal finance software. We will look beyond the features and into the behavioral science of how these tools are transforming our financial lives.

The “Spendception” Effect: Why Digital Money Feels Fake

In late 2025, researchers coined a term that perfectly encapsulates the modern financial experience: “Spendception.”

This phenomenon describes the psychological disconnect between digital transactions and the reality of resource depletion. When you pay with cash, the loss is immediate and tangible. When you pay with a card or a phone tap, the transaction is abstract.

The Psychology of “Invisible” Spending

Finance apps attempt to bridge this gap, but often they exacerbate it. By turning money into colorful charts, progress bars, and “available balance” notifications, they gamify the experience of resource management.

A study from the Journal of Consumer Research found that consumers using digital wallets spend 12-18% more on discretionary items than those using cash. Why? Because the “pain signal” in the brain (specifically in the insula, which processes negative emotions) is dampened.

Table 1: The “Pain of Paying” Spectrum

| Payment Method | Psychological “Pain” | Impulse Spending Risk | App Intervention Strategy |

| Cash | High (Visceral Loss) | Low | N/A |

| Debit Card | Moderate | Moderate | Real-time push notifications |

| Credit Card | Low (Delayed Pain) | High | “Debt projection” alerts |

| One-Click / Apple Pay | Near Zero (Frictionless) | Very High | “Positive Friction” (e.g., Are you sure?) |

How Apps Are Fighting Back

Leading apps in 2026 like Copilot and Monarch Money are introducing “Artificial Friction.” They intentionally slow down the user experience.

- The “Are You Sure?” Nudge: Some apps now ask you to confirm a purchase category before the transaction finalizes in your budget log.

- The 24-Hour Rule: Savings apps like Qapital allow you to set a “cooling off” period for withdrawals, forcing you to wait 24 hours before you can access your savings for impulse buys.

Gamification: The Dopamine Loop of Budgeting

If you have ever felt a rush of satisfaction from closing a ring on your Apple Watch, you understand the power of gamification. Fintech developers have mastered this. They use game design elements—points, badges, leaderboards, and streaks—to keep users engaged.

But is this healthy for your wallet?

The Good: Engagement and Motivation

For the uninitiated, finance is boring. Gamification solves the “boredom problem.” By rewarding users for small wins (like logging in daily or categorizing a transaction), apps build Financial Self-Efficacy—the belief that you can manage your money.

Expert Insight: “Gamification works because it hacks the brain’s reward system. It takes a long-term goal (retirement) and breaks it down into micro-doses of dopamine (a daily streak badge). This bridges the gap between our present self, who wants a cookie, and our future self, who wants financial freedom.” — Dr. Sarah Jenkins, Behavioral Economist.

The Bad: The “Green Checkmark” Addiction

There is a dark side. Users can become addicted to the game of budgeting rather than the reality of wealth building.

We call this “Metric Fixation.” You might obsess over keeping every budget category “green” to the point where you refuse to spend money on necessary life experiences or investments. You win the game (the app says you did great!), but you lose at life (you missed your friend’s wedding because it wasn’t in the budget).

List: Signs You Are “Over-Gamifying” Your Finances

- Checking the app more than 3 times a day. (Obsessive monitoring).

- Moving money between categories just to “make it green.” (Cheating the system).

- Feeling genuine anxiety when you miss a “streak.” (Emotional dependency).

- Making spending decisions based on earning “points” or “cashback” rather than need. (The tail wagging the dog).

The “Observer Effect” in Personal Finance

In physics, the “Observer Effect” states that simply observing a phenomenon changes it. The same is true for your money.

The mere act of installing a finance app changes your behavior, even if you never set a strict budget. This is primarily due to awareness.

The “Nudge” Theory in Action

Apps like Rocket Money and YNAB rely heavily on Nudge Theory—a concept popularized by Nobel laureate Richard Thaler. A “nudge” is a subtle design choice that alters behavior in a predictable way without forbidding any options.

Examples of Digital Nudges:

- Default Settings: When you set up a savings goal, the app defaults to “Auto-Save” rather than manual transfers. 90% of users leave it on default.

- Social Norming: “People like you typically spend $400 on groceries.” This comparison forces you to evaluate if you are an outlier.

- Visual Salience: Making the “Cancel Subscription” button bright red and huge, while the “Keep Subscription” button is small and gray.

Case Study: The “Subscription Purge”

In 2025, a study of 10,000 users showed that within the first 30 days of connecting their accounts to an aggregator app, users canceled an average of 2.4 subscriptions.

They didn’t cancel because they couldn’t afford them. They canceled because they saw them. The app aggregated the pain. Seeing “Netflix: $18” is fine. Seeing “Total Monthly Subscriptions: $145” triggers a loss aversion response.

Automation vs. Intention: The Great Debate

One of the most profound behavioral shifts driven by fintech is the move toward “Invisible Saving.”

Apps like Acorns (Round-Ups) and Oportun (formerly Digit) use algorithms to siphon small amounts of money from your checking account into savings. You don’t feel it. You don’t see it.

The Argument for Automation (The “Set It and Forget It” Camp)

- Removes Willpower: Willpower is a finite resource. If you have to decide to save every month, you will eventually fail. Automation bypasses the decision fatigue.

- Captures Waste: It captures the “loose change” that would otherwise be spent on frivolous items.

The Argument for Intention (The “Active Budgeter” Camp)

- Loss of Agency: When you automate everything, you lose touch with your cash flow. You might overdraw your account because the algorithm moved money you needed for rent.

- No Behavior Change: If you save $500 automatically but rack up $500 in credit card debt because you didn’t change your spending habits, you haven’t actually achieved anything.

The Verdict for 2026:

The most successful financial behavior comes from a Hybrid Model.

- Automate the Essentials: Investments and emergency fund contributions happen automatically on payday.

- Manually Track the Discretionary: Food, entertainment, and shopping should be tracked manually to maintain the “pain of paying.”

The Anxiety Paradox: Can Apps Make You Too Aware?

We are seeing a rising trend of “Fintech Anxiety.”

For generations, ignorance was bliss. You balanced your checkbook once a month. If you had money in the ATM, you bought the pizza.

Now, you have a 24/7 live feed of your net worth in your pocket. You get a push notification if a stock drops 2%. You get an email if your spending exceeds the average.

The “Checking Habit”

A 2025 survey by Bankrate indicated that 45% of Millennials check their finance apps daily. For Gen Z, that number is 60%.

While this sounds responsible, it can lead to myopic loss aversion. This is where you focus so heavily on short-term fluctuations (a bad week of spending, a market dip) that you make irrational long-term decisions (selling stocks, cancelling a necessary vacation).

Table 2: Healthy vs. Toxic App Engagement

| Behavior | Healthy Engagement | Toxic (Anxious) Engagement |

| Checking Frequency | Weekly or Bi-weekly | Daily or Multiple times per day |

| Reaction to Overspending | “I’ll adjust next month.” | Panic, guilt, or “revenge spending.” |

| Investment Monitoring | Quarterly reviews | Checking daily market moves |

| Goal Setting | “I want to retire by 60.” | “I need to hit $100k by December or I failed.” |

Coping Strategy: The “Ostrich Effect”

Ironically, when the anxiety becomes too high, users often flip to the “Ostrich Effect.” They delete the app or turn off notifications entirely because the constant feedback is too stressful. They bury their heads in the sand.

To avoid this, experts suggest “Money Dates.” Schedule a specific time (e.g., Sunday morning with coffee) to check your apps. Turn off all push notifications for the rest of the week. Reclaim your attention.

The Role of AI in 2026: From Tracker to Coach

The biggest shift in the last two years has been the integration of Generative AI into personal finance behavior.

Old apps were Mirrors—they showed you what you did.

New apps are Coaches—they tell you what to do.

The “Proactive” Nudge

Imagine this scenario:

- Old App: You spent $200 on dining out. (Information)

- New AI App: “Hey, you usually spend $150 on dining. If you skip the fancy dinner this Friday, you’ll hit your vacation goal 3 weeks early. Want me to move $50 to savings now?” (Actionable Insight).

This shifts the cognitive load from the user to the AI. It reduces the “decision paralysis” that stops many people from saving.

However, this requires a high level of Trust. You have to trust that the AI understands your life context. If the AI nags you about coffee when you are at a funeral, it breaks the trust.

2026’s Best “Behavioral” Features

- Sentiment Analysis: Some experimental apps now ask “How did you feel about this purchase?” (Happy, Regretful, Neutral). Over time, they show you a report: “You regret 80% of your Amazon purchases after 10 PM.” This is powerful behavioral mirroring.

- Peer Comparison (Anonymized): “Users with your income and city spend 20% less on car insurance. Here is a link to compare rates.” This leverages competitive instincts for financial gain.

Action Plan: Rewiring Your Brain for Wealth

So, how do you use these powerful tools without falling into the traps of gamification addiction or anxiety?

Here is a 4-step behavioral protocol for using finance apps in 2026.

Step 1: Define Your “North Star” (Not Just Numbers)

Don’t just set a goal of “$10,000.” Set a goal of “Freedom to quit my toxic job.”

- Why: Dopamine wears off. Deep emotional motivation lasts. Rename your savings accounts in your app to these emotional goals (e.g., call it “Escape Fund” instead of “Savings”).

Step 2: Add “Positive Friction”

Go into your app settings.

- Turn OFF instant purchase notifications (unless you have fraud concerns).

- Turn ON weekly summary reports.

- Force yourself to manually categorize transactions once a week. Re-introduce the “pain of paying” by engaging with the data.

Step 3: The “24-Hour Rule” for App Changes

If you feel panic because of a market drop or a bad budget month, make a rule: “I will never make a financial change within 24 hours of feeling an emotion.”

Write it down. The apps are designed to be fast. You need to be slow.

Step 4: Audit Your “Digital Environment”

Unsubscribe from the newsletters and push notifications that tempt you to spend.

- If an app sends you “Spend $50 to get $5 back” offers, delete it. That is not a finance app; that is a marketing app disguised as a tool.

Conclusion: You Are The Operating System

Personal finance apps are arguably the most powerful tools for wealth creation ever invented. They democratize access to high-level financial planning that used to cost thousands of dollars.

But they are just tools.

The software that matters most is the one running between your ears. If you understand the behavioral mechanisms at play—loss aversion, dopamine loops, and spendception—you can master these apps. You can use the gamification to fuel your discipline, use the automation to build your safety net, and use the data to design a life you love.

Don’t let the app play you. Play the app.

Recommended Further Reading & High Authority Sources

- The Behavioral Economics of Budgeting (Harvard Business Review) – Search for “Nudge Theory in Finance”

- Center for Advanced Hindsight (Dan Ariely’s Lab) – Excellent resources on the psychology of money.

- Thinking, Fast and Slow (Daniel Kahneman) – The foundational text on cognitive biases.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Behavioral trends mentioned are based on aggregated data and psychological studies available as of early 2026.